|

|

|||

Risk Management and Predictive Risk ModelingRisk management can mean many different things. The objectives of risk management is to control factors that may lead to risk being materialized. Risk management is especially important for financial institutions providing loans, mortgages, and finances, and insurance companies providing insurance coverage. For finance and insurance, analyzing past historical data can reveal factors that may constitute risk. In addition, predictive risk models using machine learning algorithms can be developed. Risk Analysis and Risk (Predictive) Modeling MethodsIn this page, the following risk analysis and risk (predictive) modeling techniques are described. More details are discussed in the subsequent sections;

For detailed discussions, also read the following links;

Principal Risk Factor Relevancy AnalysisYour organization may collect a lot of customer information. But how do you know which data (or variables) are indicative of risk prediction? How do you know that data you collected are any indicator for predicting risk? In another words, how can you determine that a variable can be a predictive factor for future risk, e.g., credit defaults or insurance claims? An answer to this is correlation analysis. Correlation is measured between -1 and 1. It indicates the degree of association between two variables. If coefficient is 1, two have perfectly positive correlation. If it's -1, two have perfectly negative correlation. It it's 0, two have no association at all. CMSR Studio correlation link analysis, shown below, is a visualization tool for many-to-many variable correlation analysis. Positive correlations are shown in bright red color, while negative correlations are shown in bright blue color.

For more on risk factor link analysis, please read Variable Relevancy Analysis / Principal Component Analysis for Predictive Modeling. Risky (Customer) Segments ProfilingProfiling main risky (customer) segments is very useful. Customers at risky customer groups may be identified using CMSR Hotspot Drill-down tools. It can identify risky customer segments through systematic search using artificial intelligence techniques. It can search profiles of risky segments in terms of risk probability, average risk amounts, and so on. For example, assume an insurance company keeps records on motor vehicle insurance information in its database containing driver and vehicle information: Gender, age, license experience, education, occupation, drinking, smoking, mobile phone use; vehicle manufacturer, type, model, year make, and so on. The company wishes to know which motor vehicle insurance is at the highest risk groups or highest average insurance payouts. The following is a possible output of CMSR hotspot profiling analysis;

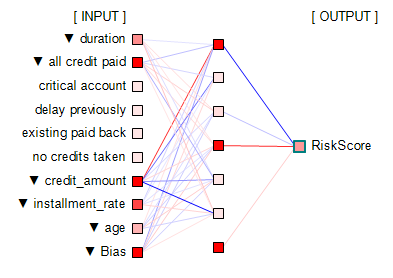

Risk Predictive Modeling by Machine LearningA predictive model is a system created and used to perform prediction. Predictive models can predict or forecast variety of things and events. Predictive risk modeling refers to the use of predictive modeling techniques to determine the risk level of financial portfolios. Different modeling tasks require different risk modeling techniques. When abundant past historical data is available, predictive modeling techniques based on machine learning, such as neural network (as shown in the following figure), can be applied. The following figure shows an example of neural network risk predictive models;

For more detailed predictive risk modeling techniques, please read; YouTube Tutorial Videos On Risk Neural Network ModelingYouTube Videos: Neural network modeling for risk management (Credit/Insurance). Risk Analysis and Modeling Software DownloadIf you need risk analysis and (predictive) modeling software, apply download from CMSR Download Request. |

|||